child care tax credit schedule

Claiming the Credit Q1-Q17 Work-related expenses Q18-Q23 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children. Additionally in general the expenses claimed may not exceed.

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Qualified Law Enforcement Donation Credit.

. Married couples filing a joint return. Cash receipts received at the time of payment that can be verified by. For a list of Step 4 child care providers go to.

The newly passed New Jersey Child Tax Credit Program gives families with an income of 30000 or less a refundable 500 tax credit for each child under 6. 13 opt out by Aug. Complete Schedule 8812 Form 1040 Credits for Qualifying Children and Other Dependents.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. Enter your Step 4 child care expenses in column B. Qualified Foster Child Donation Credit.

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit. You will need the following information if you plan to claim the credit. For children under 6 the amount jumped to 3600.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Under the American Rescue Plan each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. For example contributions to a child care resource and referral agency such as Child.

These people qualify for a 2021 Child Tax Credit of at least 2000 per qualifying child. Tax Credit Forms You may also need. Up to 8000 for two or more qualifying people.

Canceled checks or money orders. People who are eligible for a partial amount of Child Tax Credit. To claim the Ontario Child Care Tax Credit file your tax return and submit a completed Schedule ON479-A Ontario Childcare Access and Relief from Expenses CARE Tax Credit.

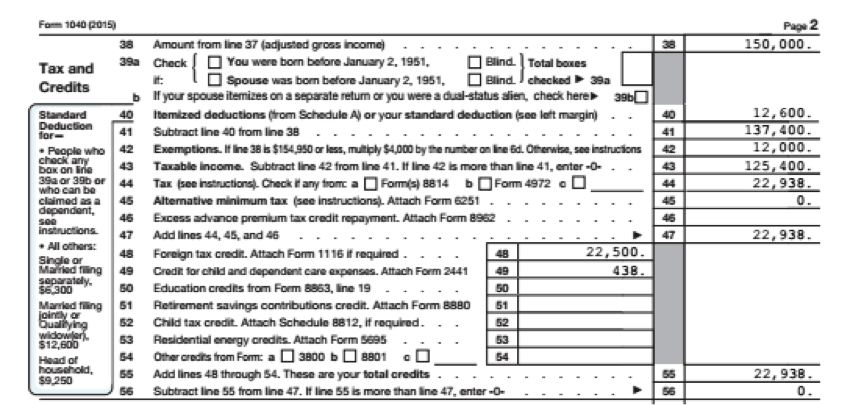

Formerly known as the Early Learning Tax Credit the District of Columbia Keep Child Care Affordable Tax Credit Schedule ELC is a refundable income tax credit that was enacted in. You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 US. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The Instructions for Schedule 8812 explain the qualifications for CTC ACTC. 30 of the total amount spent by an organization to help employees locate child care. In general for 2021 you can exclude up to 10500 for dependent care benefits received from your employer.

WASHINGTONThe Internal Revenue Service sent 11 billion in advanced child tax credit payments during 2021 to people who shouldnt have gotten them and failed to send. Canada child benefit CCB Includes related provincial and territorial programs. Otherwise use only column A to calculate your child care credit.

Federal Tax Changes Need Help. Individual Income Tax Return and attaching a completed. 15 opt out by Aug.

Up to 4000 for one qualifying person for example a dependent who is under age 13 who needs care up from 1050 before 2021. Parents with children aged 5 and younger can qualify for a 300 monthly child and dependent care credit while older children aged 6-17 years old will be given a 250.

Irs Audit Letter 566 Cg Sample 3

Colorado Child Care Contribution Credit Boulder Jcc Jewish Community Center

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Irs Schedule 3 Find 5 Big Tax Breaks Here

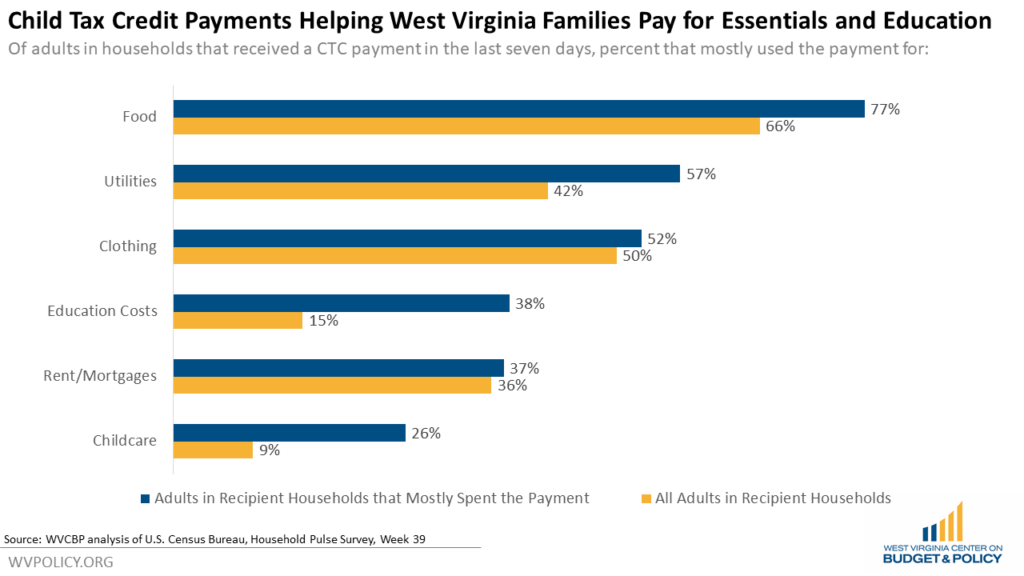

The Enhanced Child Tax Credit Is Helping West Virginia Families Invest In Child Education And Care West Virginia Center On Budget Policy

New Child Tax Credit Takes Effect In Pennsylvania 90 5 Wesa

About The 2021 Expanded Child Tax Credit Payment Program

Child Tax Credit Dates Here S The Entire 2021 Schedule Money

/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Irs Form 2441 What It Is Who Can File And How To Fill It Out

Childcare Contribution Tax Credit Special Kids Special Families

What To Know About The First Advance Child Tax Credit Payment

The Child Care Credit And Your Us Expat Tax Return When Abroad

How To Claim The Child Tax Credit Up To 8 000 For Child Care Expenses Nextadvisor With Time

Save On Child Care Costs For 2021 Dependent Care Fsa Vs Dependent Care Tax Credit

Child Care Contribution Tax Credit The Family Center La Familia

What Is The Child Tax Credit Tax Policy Center

2021 Child Tax Credit Earned Income Tax Credit Child Dependent Care Deductions Alabama Cooperative Extension System